Monday, May 15, 2006

Ethanol

Thursday, May 11, 2006

Brazilian Sugar Cane Ethanol

Now, with the introduction of "flex" vehicles, (allowing users to choose their fuel mix ratios) the consumer has more power than it did by relying solely on oil based fuel. Not to mention, creating thousands of jobs in Brazil's poorest regions also helps the economy tremendously. It not only gives jobs to those that would never previously have been able to attain one, but it substantially reduces the strain on many Brazilian cities, of which large parts tend to be slums. Producing sugar cane ethanol is "profitable as long as oil costs more than $37 a barrel."

I think from an efficiency standpoint, this seems to be an extremely efficient move by Brazil. Creating jobs within the country, reducing dependence on foreigners, reducing prices of fuel, and reducing stress on cities to support their impoverished populations are all benefits of this move. The only people that seem to be worse off are the OPEC guys.

Wednesday, May 10, 2006

California's ZEV (zero emission vehicle) program

In 1998, car companies convinced CARB that they could not meet the deadline, and the 2% mandate was delayed until 2003. In 2002, the car companies sued the state, to which the state decided to sidestep the legal problem and continue to restore the ZEV program for 2005.

On one hand, the ZEV program has done alot in the name of progress towards increasing the potential we have to reduce air pollution stemming from vehicles. However, it has done so in an extremely inefficient manner, and has had little effect on the air quality so far.

From an econonmist's perspective, I would recommend the state cancel the ZEV program. Forcing a company to produce and sell a car that is not high on their efficiency list is just not the solution to the air problems in the state. The state should provide an incentive for consumers to purchase the more efficient products. One incentive that comes to mind is a tax credit equal to the pollution saved in a given year. Simply test the car to see it's pollution per mile, and record the mileage of the car for tax records.

From an efficiency standpoint, it helps the manufacturers utilize the market to decide what is best for them. It helps the state because more people will see the incentive in tax savings and the incentive to help clean the air and make a judgement on whether or not to buy the more efficient vehicle.

Thursday, May 04, 2006

Cafe Standards

Tuesday, May 02, 2006

CAFE Standards

Monday, May 01, 2006

France: Now that's Nuclear

So what are the economic benefits?

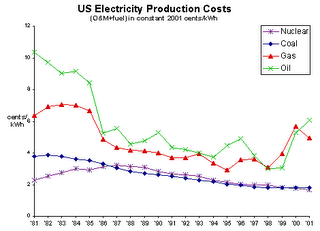

• Nuclear power is cost competitive with other forms of electricity generation, except where there is direct access to low-cost fossil fuels.

• Fuel costs for nuclear plants are a minor proportion of total generating costs, though capital costs are greater than those for coal-fired plants.

• In assessing the cost competitiveness of nuclear energy, decommissioning and waste disposal costs are taken into account.

The U.S. looks about the same as coal to me, but if France does not have access to coal then it would be cheaper than any of the other sources.

Market for used tires?

"Environmental fees are state-mandated charges applied when you purchase new tires.

In many states, the funds raised by the collection of environmental fees go towards research and development on recycling worn out tires as an option to placing them in landfills. You may not know this, but materials reclaimed from old tires are used to power electrical plants, stop erosion in watersheds, assist in the drainage of golf courses and greenbelts, and can even be used in the construction of new homes."

To which I said inefficient!! If the market can find a value for the disposal services of tires, why then would the state mandate a fee associated with disposal. Why aren't they paying me for disposal of tires, if after all they are valuable. Its this type of policy that makes me wish politicians should be required to have a degree in econmics.

Price Of Gas Is High!!

Who do you think makes the most money on the sale of a gallon of gas? I'll tell you. It’s not “Big Oil.” It’s Big Government. Gas taxes are worth 5 to 10 times what gas profits are. The federal and state governments use the tax money to build roads, while the oil and gas companies reinvest their profits into equipment and infrastructure.

Gas prices are higher now. That can be blamed on three groups of people.

1. The environmental lobby: They are primarily responsible for the fact that a refinery hasn't been built in

2. The federal government: For listening to the environmentalists and not acting faster to promote alternative fuels.

3.

Congress is calling for price-gouging investigations and a windfall profits tax. If price-gouging had occurred, we’d already know about it. And a tax on excess profits is simply a bad idea and sends a terrible message to other industries. Plus, the money would be wasted by the government.